- Transformation of the Australian mining industry and future prospects

- Rio Tinto Australia

- BHP

- Fortescue Metals Group

- Development of mine communication technology

- Development of ICTs and big data-based mining technology

- Autonomous haulage system in surface mine

- Electric vehicles for the mining industry

- Conclusions

Transformation of the Australian mining industry and future prospects

Hyongdoo Jang and Erkan Topal

Western Australian School of Mines: Minerals, Energy and Chemical Engineering, Science and Engineering, Curtin

University, Kalgoorlie, WA, Australia

Australia is a resource-rich country that produces 36% of the world’s iron ore, 63% of the world’s

lithium, 30% of the world’s bauxite and 10% of the world’s gold as of December 2018 (Geoscience

Australia 2020a). Mining is a major industry in Australia that accounts for approximately 8.7% of GDP in

2019, and its export values are forecast to reach AUD $300 billion in 2019–2020, which is more than

the combined exports of other industries during the same period (Thurtell 2020).

Since the early 2000s, major mining companies began to apply advanced ICTs (information and

communications technologies) to their entire mining processes, expecting great improvements in both

safety and productivity. Indeed, ‘digitalization’ is the biggest driver of change in the current mining

ecosystem and will revolutionize the traditional mining value chain. According to the 2017 World

Economic Forum’s mining sector report, the improved mining industry through smart sensors,

automated equipment and automated operations centres will produce US $321 billion in value from

2016 to 2025 and reduce approximately 600 million tonnes of CO2 (World Economic Forum® 2017).

What changes will automation and digitalization, which are distinguished as Mining 4.0, bring to the

mining ecosystem? According to a report in 2015 by McKinsey Global Institute (MGI), mining

companies will save 5- to 10% of the operating costs of mining equipment by 2025 through information

processing and analysis. Furthermore, it is also estimated that the Internet of Things (IoT) will bring

worldwide economic benefits of US $160-930 billion per year in the energy and resources industry

(Manyika et al. 2015). According to the study from Price (2017), the initial cost of operating 10

autonomous haulage trucks was approximately AUD $18.5 million but would increase productivity by a

total of AUD $22.5 million, including an annual wage of AUD $2.7 million and a reduction in tyre costs of

AUD $1.2 million. Pareira and Meech’s study is limited to automatic haulage systems, but the socio

economic benefits will be tremendous if the inte- grated smart mine management system is established.

The impact of automation and digitalization of mining ecosystems can be gauged by the policy changes

of major mining companies.

Rio Tinto Australia

Rio Tinto established the Centre for the Mine Automation at the University of Sydney in 2007 in

conjunction with Komatsu Japan. Rio’s Mine of the FutureTM programme is considered the most

ambitious plan in mining history.

The Mine of the FutureTM programme strives to optimize not only the centralized remote operations but

also every element of the entire mine process through the introduction of many innovative information

and communication technologies and automation technologies. According to the report from Salisbury

(2018), autonomous haulage system (AHS) and autonomous drilling system (ADS) operated in iron ore

mines in Pilbara improve the operating rates by 11% and 26%, respectively.

BHP

BHP has also continued to invest in mining automation and digitalization. BHP reported that ADS

increases productivity by 25% and decreases drilling costs by 40%. In addition, the Jimblebar iron mine

in Pilbara WA reported that the operation of AHS decreases 80% of safety accidents that have been

caused by conventional haulage trucks (BHP 2019). BHP opened the Maintenance Centre of

Excellence (MCoE) in Adelaide, Brisbane and Perth as part of its integrated mining management

system. The latest information and communication, information processing and soft computing

technologies have been used to analyse real-time information at mining sites and provide a decision-

making system. It is also predicted that the mine management standardization of more than 40 mines

worldwide will reduce costs by US $1.2 billion/year by 2022, which is approximately 20% of the total

mine management cost of US $3.5 billion per year where those mines have been managed with their

own respective know-how (BHP 2017).

Fortescue Metals Group

In 2009, the FMG opened the Integrated Operation Centre (IOC) at the headquarters of the FMG in

Perth. After the pilot operation of the AHS based on Caterpillar’s MineStarTM in the Solomon Hub mine

in 2012, the FMG has operated 128 AHS trucks in four iron ore mines in Pilbara, which is the largest

number of AHS operations in Australia as of 2019. The FMG’s steady eforts to automate and digitize

mines have reduced the cost of iron ore production (C1 cost1) to US $13.11/wmt2 in 2019, which is only

50% of their C1 cost (US $27.15/wmt) in 2015.

Development of mine communication technology

Mining is a traditionally human power- and machine- driven industry, and eforts for automation have

advanced in processes where the risk is high. However, automation in the mining industry is

progressing slower than in other industries due to the limitations of communication technologies in the

rough environment in mine sites. Mine communication systems are very important not only for

production management but also for safety reasons. Furthermore, the establish- ment of a stable and

efcient communication network platform should be a priority to achieve mining optimization through

automation and digitalization. Based on the stable mine communication backbone, it is possible to

prevent accidents and maximize productivity by establishing systematic mine operational technologies

(OT) and information technologies (IT).

A surface mine that operates with AHS should have a local network that can reliably maintain a

constant data transfer rate. The operating system installed on the AHS truck communicates with the

operation centre of the site and mine integrated operation centre in real time about AHS trucks’ location

and data generated from various sensors installed for vehicle management, daily updated terrain and

route of the mine information and information of other equipment operations of the entire mine. For this

purpose, most open mine area networks use high-speed communication systems such as Wi-Fi (802.11

bands) that can maintain data transmission speeds above a certain level. Recently, it also started

commercializing private long-term evolution (LTE) communication technology for the operation of

Komatsu’s FrontRunner AHS (Australian Mining 2019).

Development of ICTs and big data-based mining technology

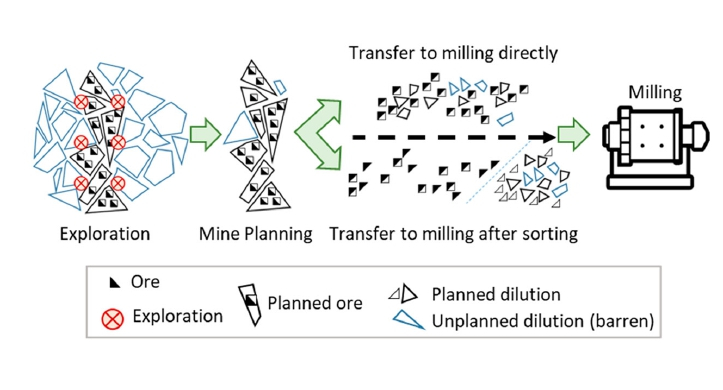

Mining is an industry with inherent uncertainties. Even cannot identify the exact shape and grade of a

mineral deposit. Even if a three-dimensional resource model is constructed and evaluated through

analysing drilling samples obtained from exploration drilling, it is noth- ing more than a statistical model

using geostatistical methods. In mining, it is inevitable to have a certain amount of planned dilution in

the mine planning stage and unplanned dilution that can occur at the production stage. Proper

production management and adequate ore classification processes can increase the mill head grade.

Otherwise, significant losses will occur due to processing low-grade ore or waste. Various sensors and

the latest ICT technologies applied to modern mining produce enormous amounts of data every day.

These data are analysed through var- ious advanced data processing technologies and enable a

reasonable reconciliation in each part or the entire mining process. In addition, establishing various

data-based decision support systems facilitates more integrated and rational decision-making beyond

the conventional management system that relies on the know-how of each site or the empirical intuition

of expert engineers.modern high-tech mineral exploration technologies

Autonomous haulage system in surface mine

A study on AHSs started in the mid-2000s and was led by world-class mining manufacturing

companies, such as the MINESTARTM system from Caterpillar and FrontRunner AHS trucks system

from Komatsu. For safe operation of AHS trucks, the location of the truck, information on adjacent

objects, the route to the destination, and the location information of other equipment should be updated

in real time. These data are transmitted to AHS trucks, on-site operations centres, and remote

integrated operation centres via local networks.

The AHS truck system is perceived as an icon of mine automation, leading mining companies to

scramble to increase the number of AHS trucks despite huge initial costs. According to years of on-site

verifications, the AHS truck system is invigorating the mining industry by improving the productivity and

safety of mines and expanding new business areas related to mine automation and digitalization.

Electric vehicles for the mining industry

The trend of preferring electric cars as a means of daily transportation is increasing with rapid

technological evolution, such as battery performance and inverters, as well as increasing price

competitiveness compared with internal combustion engine vehicles that have been blamed for air

pollution. This trend can also be found in the mining industry. In the case of under- ground mines,

severe air pollution caused by the operation of internal combustion engines is directly related to miner

safety. Furthermore, the energy required to operate the ventilation system to remove toxic gases

(NOx, SO2, CH4, CO2, and CO) and particle matter accounts for nearly 40% of the total energy use of

underground mines (Kocsis and Hardcastle 2003). To overcome the problems caused by the use of

internal combustion engines in underground mines, research on underground mine battery electric

vehicles (BEVs) has recently been actively carried out.

Atlas Copco announced that it would steadily increase the production of electric-powered mining

equipment. Epiroc, a mining equipment company separated in 2017 from Atlas Copco, is gradually

expanding its scope of mine electric vehicles to loaders, jumbo drills and underground trucks with the

catchphrase of ‘zero-emission and battery-driven machinery’ (Epiroc 2017). Figure 9 shows the second

generation of electric-powered underground mining equipment fleet and the ability to swap batteries.

Sandvik began development by acquiring Artisan, an electric power equipment maker, and Caterpillar is

also increasing its investment in electric power equipment on its own. As an example, in 2019, the

Caterpillar developed an electric LHD (R1300GLHD) equipped with batteries and compared

experiments with conventional diesel engine LHDs to identify their performance and applicability. In

particular, the comparison of energy costs showed that the electric LHD was US $3.66/run,

approximately one-tenth of the US $37.50/run of the diesel engine LHD (Gleeson 2018). These electric

powered mining equipment are being commercialized through on-site verification. The first underground

mine operating the electric-powered equipment was the Macca gold mine located in Ontario, Canada,

in 2013. The mine reported that electric-powered equipment contributes 70% of the mine’s production

(Jones 2018). In 2019, Glencore, Canada, announced that a new deposit named’Onaping Depth’ found

at the bottom of Craig’s underground mine 2600 metres below ground will be fully operated with

electric-powered equipment. The mine is expecting to reduce energy costs by 41% and ventilation

costs by 40% (Boissonneault 2019). In addition, Goldcrop Inc. along with Sandvik announced that they

will only run electric-powered equipment at the Borden Lake gold mine in Ontario, Canada (Taylor and

Lewis 2018). In Australia, Caterpillar conducted a test run of an R1700 electric loader at the Tanami

mine operated by Newmont in the Northern Territory. Given these trends in the mining industry, the use

of electric-powered equipment in underground mines is expected to increase steadily in the future.

More information on electric vehicles in mining can be found in the publication from Global Mining

Standards and Guidelines (GMG 2018).

Conclusions

Humans have been collecting minerals for thousands of years and the demand for minerals is steadily

increasing with the growth of the population, industrialization, and technological development. Now,

high-grade ore near the surface is almost depleted, and the mines are becoming deeper and more

challenging. In fact, modern mining should be produced at extremely deep underground or low-grade

ore with minimal environmental damage. Many mining companies are trying to overcome these

difculties by improving productivity through the automation and digitalization of mines.

The recent rapid development of ICTs and soft computing technologies has created a new paradigm:

Mining 4.0 with mine automation and digitalization, which means:

- Changes in mining hardware through automation of robots or equipment.

- Changes in mining software that can build advanced decision-making systems through advances in information processing technology for data accumulation and real-time analysis through various sensors.

- The establishment of an integrated management system that manages all hardware and software in a high-speed communications environment with augmented 3D visualization.

given the rapidly revolutionizing ICTs, soft computing and big data technologies, the Australian mining

industry considers the coming few years to be a significant turning point for the mining industry. During

this period, many mining-related new technologies based on information communication and data

analysis will be introduced and deployed. In fact, the mining industry is already in the transition period

from conventional mining to the new era of mining, which has become a melting pot of new

technologies from many other engineering disciplines. Now is the most dynamic moment in the history

of the mining industry because of the adoption of various advanced technologies from various

engineering disciplines. As the Australian mining industry has been leading the industry for centuries,

now is the time to strengthen the Australian mining industry for the next centuries again by liberally

introducing advanced technologies to the mines with high priority and enthusiasm.