Executive Summary

Our survey shows who in the industry is

implementing new technologies and what

they have achieved so far

Beth McLoughlin

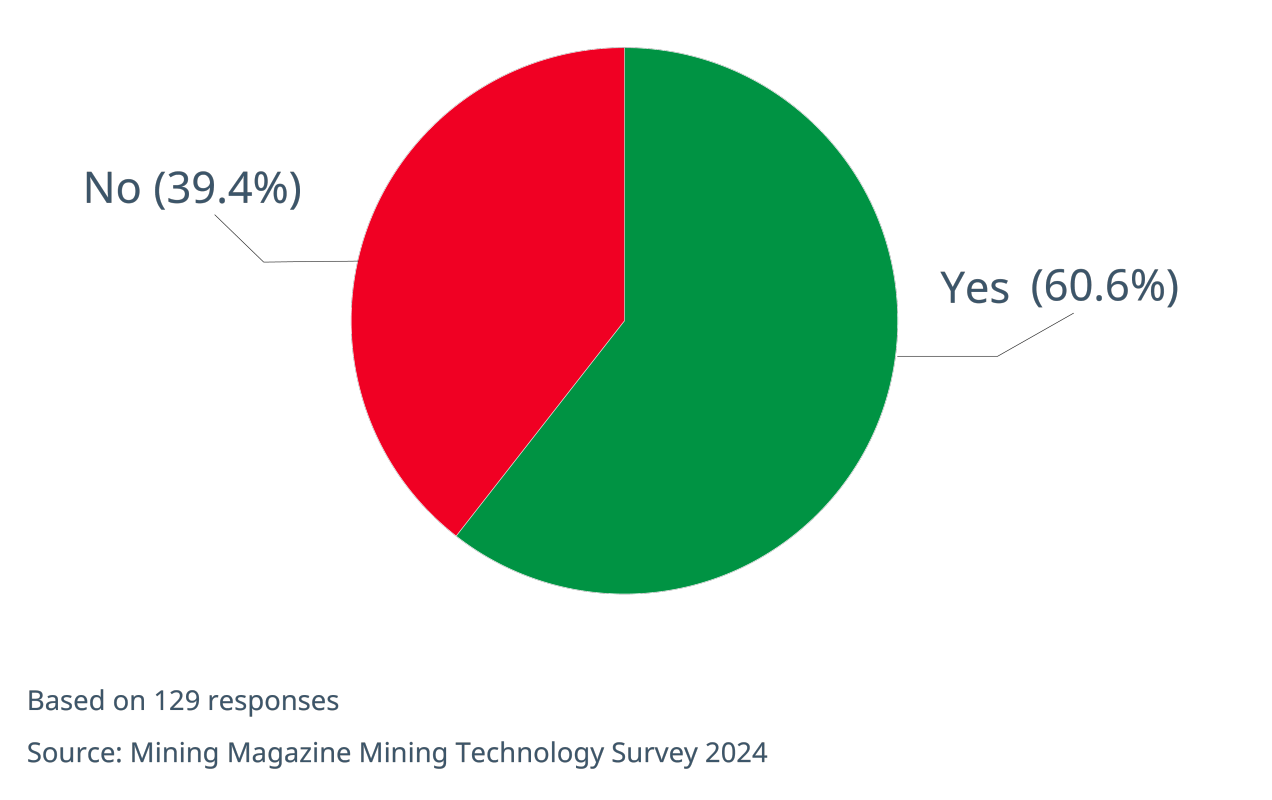

Our survey received responses from 223 mining

professionals. Of the 129 who answered the question ‘To

date, has your company (or a company you have invested

in) deployed or developed automation technology?’,

nearly two-thirds (60.6%) said their organisation had.

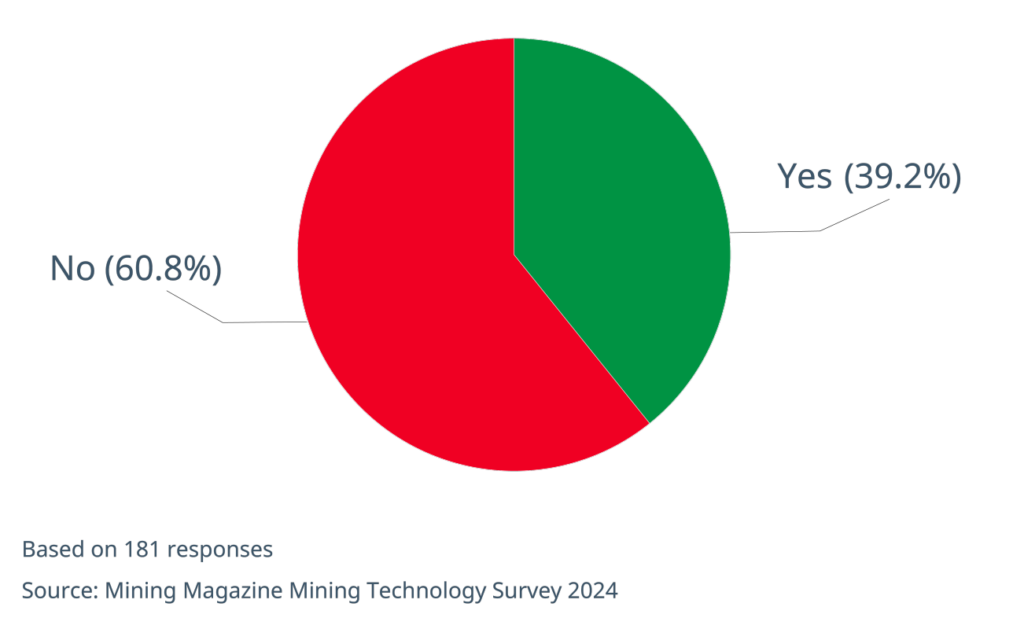

When it comes to those who have used artificial

intelligence (AI) to drive efficiencies in the mining

company they work for or have invested in, just under

two thirds have not deployed this technology yet.

To date, has your company (or a company you have invested in) deployed or developed automation technology?

To date, has your company (or a company you have invested in) deployed or developed AI technology to drive

Digitalisation and automation are clearly being

widely used by miners who want to optimise

operations, but different technologies are advancing

at different speeds.

When we started putting these reports together,

we treated automation and digitalisation separately.

This year, we have decided to bring them together,

for several reasons.

Digitalisation projects very often revolve around

automation, with mining companies increasingly

choosing to automate some of the more dangerous

parts of their operations and move operators away

from heavy machinery, ultimately into remote

operating centres (ROCs) where possible.

There is no way to achieve that without moving

away from manual processes and using sensor and

other data to plan operations – ie, without a full

digitalisation program.

ROCs such as Rio Tinto’s operations centre in Perth,

from where 50 autonomous trucks are operated in

Pilbara nearly 1000 miles away, are only made

possible using the latest technology. For example,

the BHP ROC in Santiago can handle 5.4 terabytes of information every day.

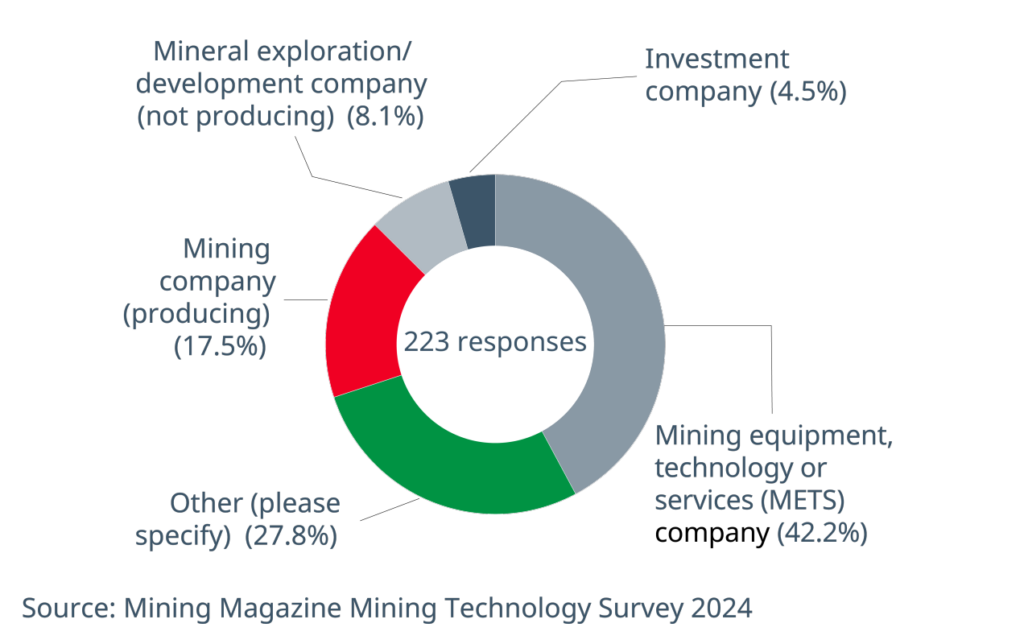

Who we asked

First, a word on the methodology we used to put this

report together. We received 223 responses to our

What kind of company do you work for?

Where is your company HQ?

survey, with 42.2% of these coming from mining

equipment, technology or services (METS) companies.

Mining companies (producing) made up 17.5% of

respondents, while mineral exploration companies

that are not currently producing were 8.1% of the

whole. Investment companies accounted for 4.5%

ȬLjЯɞƦɫɖȬȝɫƦɫмЮ

Of all respondents, 44% were in senior or middle

management, with 22.9% at the board level or on

the executive committee of the company they work

for, meaning that a significant number can be

described as decision makers.

More than one in 10 (12.1%) of respondents were from companies with market capitalisation of more than US$5 billion, with 10.8% in the $1 billion to $5 billion category, and 29.6% from companies with

market caps of less than $250 million. Almost a

third (29%) were from private companies or chose

not to disclose their company market cap.

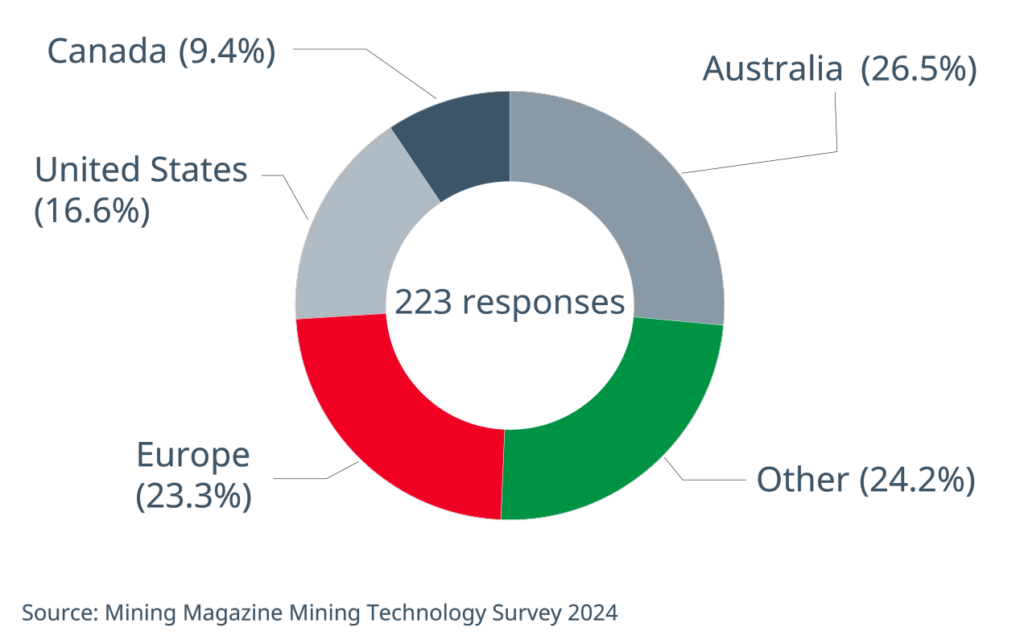

Respondents were from across the globe, with 26.5%

in australia, 16.6% from the US, 23.3% from Europe and about a quarter from other parts of the world.

and about a quarter from other parts of the world.

Picking priorities

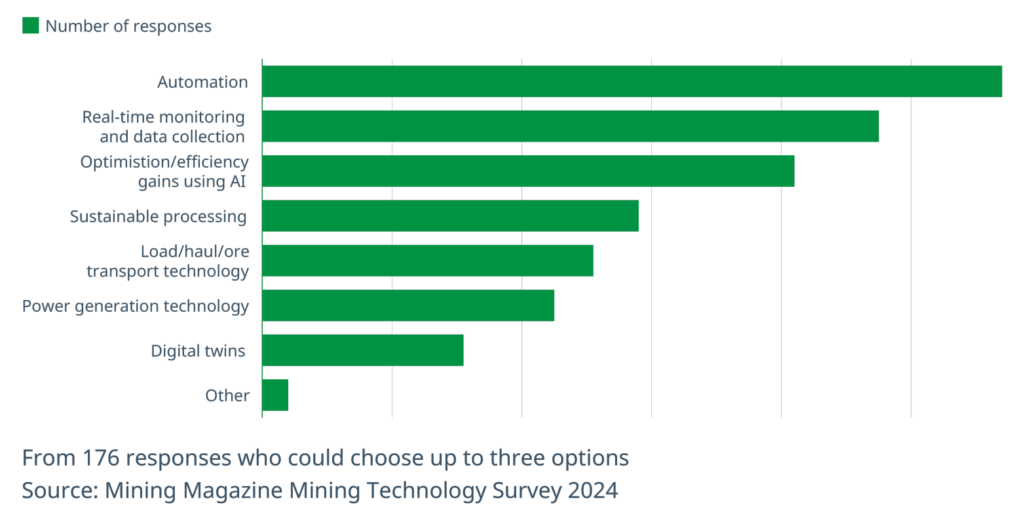

Even though roughly a third of our respondents had

not yet deployed automation in their operations,

it came out top of the list of priorities when

professionals were asked what would be most

important to miners by 2030.

Next on the list was real-time monitoring and data

collection, which is not a surprise as this is essential

to any kind of automation program. In tough price

environments for many metals and minerals,

collecting data in real time can help drive

efficiencies. Despite becoming a buzzword since the rise of generative AI in many industries,

optimising and improving efficiency through AI was only third on the list

In 2030, which technologies will be mining's top priorities?

AI has been cited as driving improvements in

operations such as ore sorting, with an expert

recently telling Mining Magazine that AI-integrated

solutions can increase mineral yield by 15-20%,

reduce transportation costs by 25-30% and drive

sustainability.

A separate study by researchers at Charles Darwin

University in Australia found that AI algorithms

could predict gas-related incidents in coal mines

30 minutes before they occur. The ability of machine

learning to process information much more quickly

than before means that new use cases are always

being discovered.

It is possible that the true impact of AI on mining is

not yet known. For instance, work by SRK Consulting

found that it could have a huge impact on safety,

simulating 20 years of blasting sequences in just a

few days so that the risks associated with explosives

in surface mining can be radically reduced.

Fourth on the list was sustainable processing.

A survey by Mining Magazine Intelligence conducted

earlier in the year found that processing was the

number one mining operation companies thought

could be transformed by AI.

New technologies, such as direct lithium extraction

(DLE), are already making waves in the industry.

Not only can they reduce the energy required to

process source material, but they often save money

and time

Machine learning can make small adjustments

in processing, identifying any material that will

cause problems further down the line, and altering

parameters such as heat and quantity of reagent

in real time

The next two on the list were load/haul/ore transport

technology and power generation technology, which

scored almost the same number of responses, with

transport slightly higher.

Fully automated trucks, such as the electric T 264

unveiled by Liebherr and Fortescue at the most

recent MINExpo grab headlines and are increasingly

becoming established in mines across the world.

Australia leads the way here, but even in regions

where full automation is not the norm, mine sites are

using aspects of it, such as collision avoidance

systems, to improve safety and optimise operations.

The reason power generation technology comes in so

close to transport is likely that they are very closely

linked. Replacing drills, load haul dump (LHD)

machines and other heavy equipment is also an

opportunity to electrify operations, and that comes

with power challenges.

Another buzzword in recent years, digital twins,

came in as the lowest on the list of technologies our

respondents thought would be top priorities in

mining by 2030, though still significant.

Digital twins can help mining companies with

predictive maintenance and efficiency, and are used

to test out scenarios in the virtual world before they

can have an impact on the real one. However, many

companies have some form of a digital version of

reality already, though they might not consider this

to be a digital twin.

Digital twins are sometimes described as hype,

but they can have an important role to play in asset

management in mining and in avoiding expensive

shutdowns or downtime.

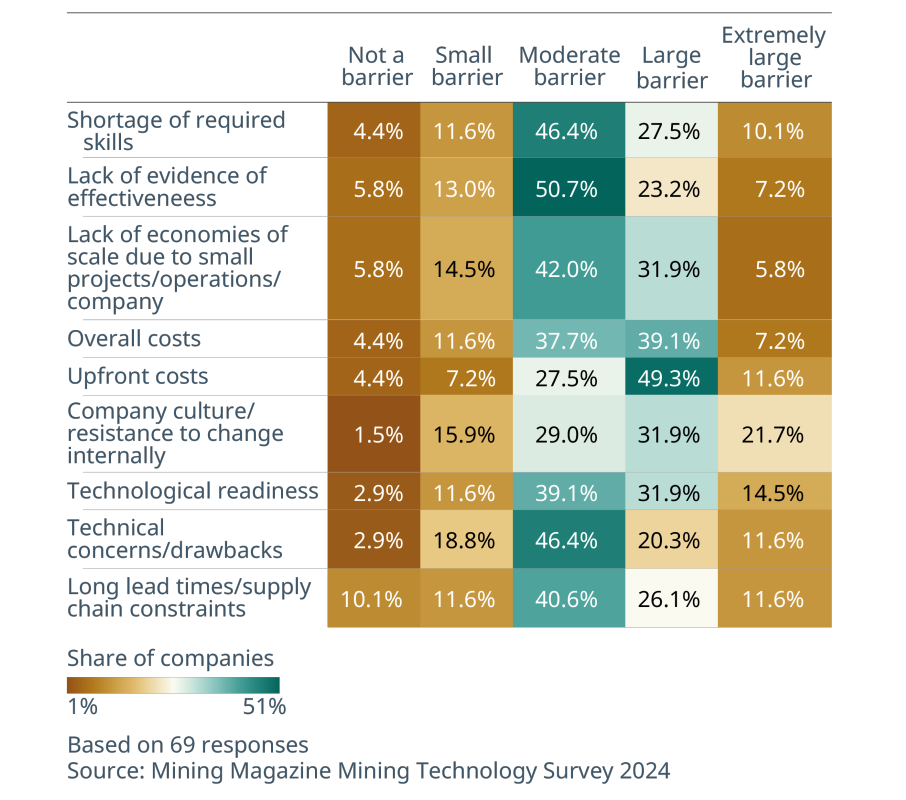

Remaining challenges

The paradox of implementing automation and

digitalisation programs is that their success depends

How big a barrier are the following factors in the uptake of emerging and innovative technologies in mining?

on the humans that deploy and operate them. We

asked our respondents what the biggest barriers were

to the uptake of emerging and innovative technologies

in mining, and the answers were revealing.

Company culture and internal resistance to change

were viewed as a “large barrier” for almost a third of

those we surveyed, and a “moderate barrier” for just

under a third.

About half said lack of evidence of effectiveness

held them back and was considered a moderate

barrier, while this was a large barrier for 23.2% of

those in the survey.

Perhaps unsurprisingly, upfront costs were also a

concern, with almost half citing this as a large

barrier and a little under a third saying it was a

moderate barrier. That picture might look different

for junior miners without the deep pockets of the

majors, but combined with the lack of evidence for

effectiveness, the results suggest that miners are

unwilling to commit large sums of money for

something they cannot be sure will get results.

Technical concerns and drawbacks were viewed by

almost half of respondents as a moderate barrier to

the uptake of emerging technologies.

Other significant barriers included the long lead

times and supply chain constraints, which can mean

it takes time to implement new tech. This was cited

as a moderate barrier to uptake by 40.6% of those

who answered our question on obstacles. Meanwhile,

a shortage of the required skills was seen as a

moderate barrier to uptake for almost half.

Success stories

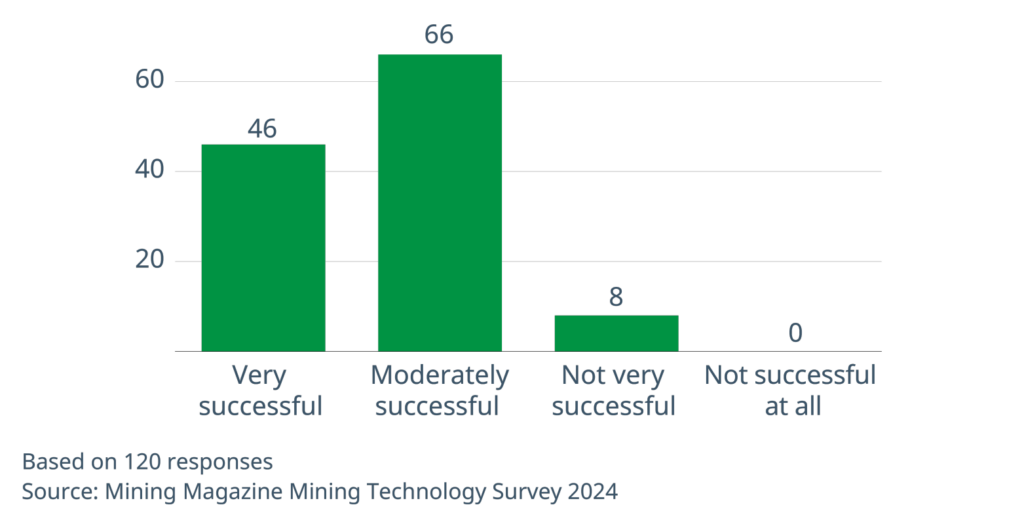

As we have seen, about two-thirds of survey

respondents have deployed or invested in automation

for a mining company while only about a third have

done so with AI. From 120 responses, covering those

that had implemented automation technology, no one

said it had been unsuccessful. Only eight found it had

been “not very successful” with a majority reporting

moderate success and 46 responding that automation

had been “very successful” for their organisation.

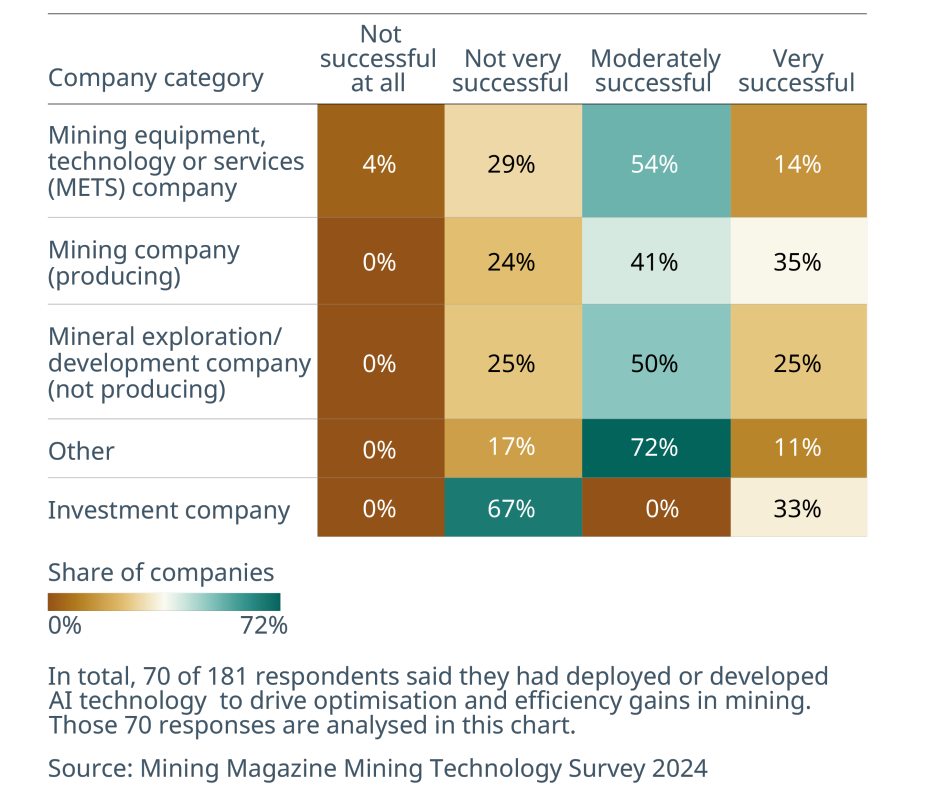

When it comes to AI, there have also been

successes, but our responses suggest this is more of

a mixed bag. While a large number of companies of

different kinds reported that the deployment of AI

had been moderately successful, quite a few of our

How successful has automation technology been overall for your company (or the mining industry)?

70 respondents to this question, those that had

implemented AI, were less enthusiastic.

Of those respondents from mining equipment,

technology or services (METS) companies, 29% said

AI had not been very successful for them. A quarter

of mineral exploration and development companies

said the same, while 24% of producing mining

companies also reported that implementing AI had

not been very successful.

The picture was even bleaker for investment

companies, with 67% saying it had not been very

successful.

How successful has AI been overall for your company (or the mining industry)?

To fully understand why, it might be necessary to

determine exactly what kind of AI these companies

used. Machine learning for ore sorting could bring

different results to using generative AI to summarise

investment meetings, for example.

Looking ahead

2030 was the date we asked survey respondents to

look forward to, partly because so many mining

companies have ambitious sustainability targets

to reach by that time.

Without monitoring current performance

through data or deploying technologies that can

drive efficiencies, meeting these goals looks

tougher to do.

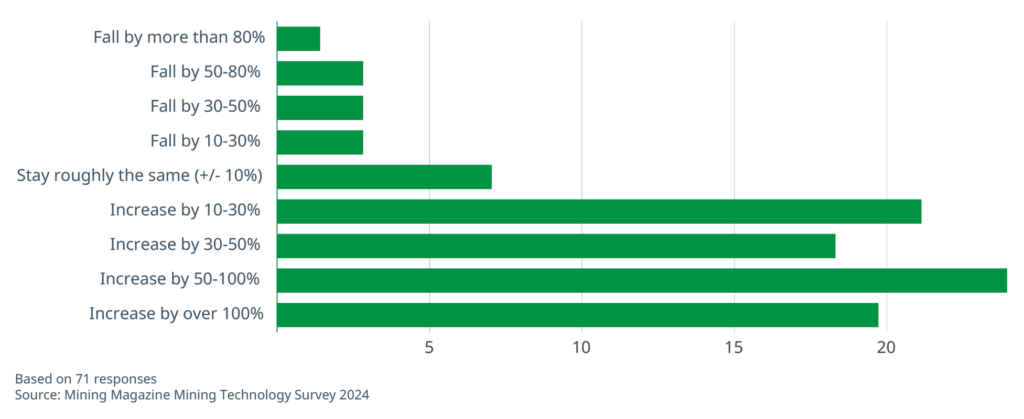

Most thought spending on AI will increase, with the

majority of those in our survey backing an uptick of

50-100% in six years’ time. A little under a third had

more modest expectations of a 10-30% increase by

2030, while a significant number thought that

spending on AI in the mining industry will go up by

more than 100%.

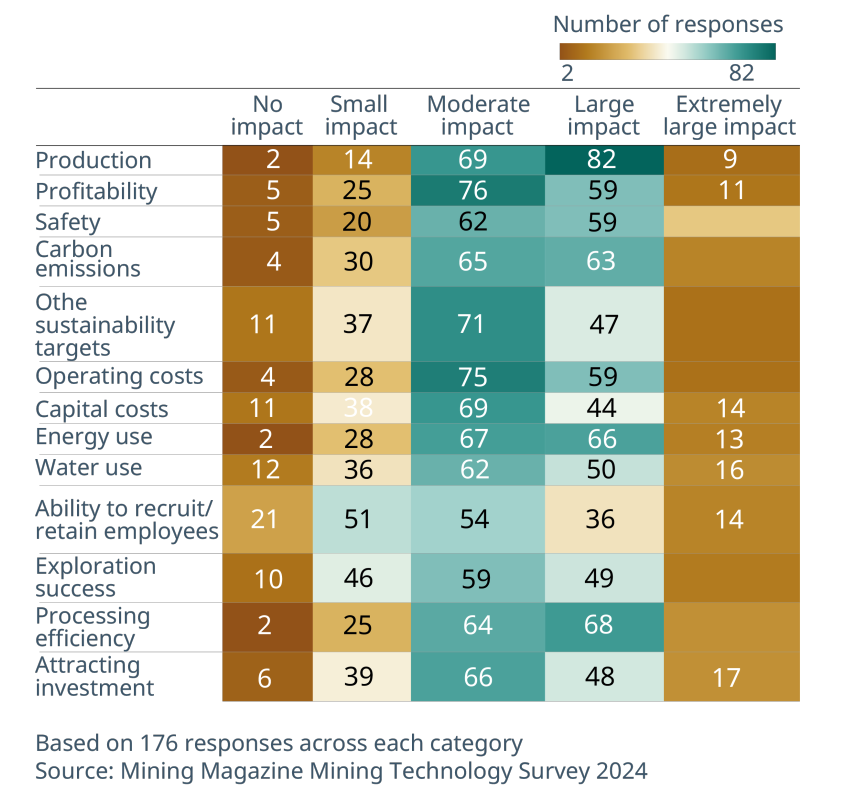

We also asked where the positive impact of emerging

and innovative technologies will be felt in the mining

industry.

Our respondents predicted that these technologies

will have a large impact on production, and a

moderate impact on profitability. Operating costs

were also singled out by a high number of survey

respondents as an area that will be moderately

impacted by innovations.

By 2030, how big a positive impact will emerging and innovative technologies have on:

Sustainability targets and tackling carbon emissions

were also seen as factors that could be positively

affected by new technologies.

While the companies in our survey – and in the

industry more widely – might be at different stages

in their journey, our findings suggest that there is

only one direction of travel when it comes to

digitalisation and automation.

Navigating the technology landscape may not be

easy, but our respondents are clear that there are

significant gains to be had for those that do.

How do you expect spending on AI in the mining industry to change by 2030?