Business Background

- The Mining industry, which accounts for almost 11% of Australia’s GDP, is the largest consumer of commercial lubricants in the country, (followed by the road freight trucking sector).

- Castrol is the market leader in terms of volume share and has built a strong position in the Mining sector in Australia over 30 years, enjoying noticeable growth in recent years, through lockdown.

- Castrol Mining has significant industry knowledge, supply capability and client-base but is also aware there is a business imperative to explore now what is needed to stay relevant in this evolving sector in coming years.

- The Mining team in Australia asked Castrol Global for support in Q4 2023 to understand what is needed to stay relevant in Mining in coming years. The expressed aim was to avoid ‘failing forward’ whilst doing business as usual and meeting fiscal & growth targets

- During our engagement, the project was widened out from AU - meetings were held with Castrol Mining teams in other countries, Middle East, KSA, ID, IN, TR, US, ZA.

Study Participants

Australia n=7

Participants:

- OEM Construction Aftersales Manager & KAM.

- Contracts & Procurement GM & Manager.

- Category Specialist Buyer

- Category Contracts Manager

- Asset Management Lead

- Procurement Lead

- Global Procurement

Indonesia n=2

Participants:

- Procurement Co- Ordinator

- Head of Plant

South Africa n=2

Participants:

- Sales manager

- Condition Monitoring Technician

Turkey n=3

Participants:

- Procurement Manager

- Procurement

- Site Manager

USA n=1

Participants:

- Strategic Sourcing Manager

The 5 key insights from the desk research have been affirmed

Mining Requirement – Customer & SME Feedback

Sustainbility

Safety

Cost Efficiency

Uptime

Suppy Reliability

5 Critical ‘fail forward’ conditions for Castrol to navigate

They are far more aware of global trends and their need to be agile to capitalise/react. They are divesting of ‘dirty’ assets (coal for power).

Clients want to reduce their external direct spend.

A rise in ‘sustainable procurement’ encompassing environmental, social, and governance (ESG) aspects for Scope 3 emissions.

Ease of working together, in long-term, global/multi-country contracts is desirable.

Other suppliers are communicating on global deals, transparently, bringing in organisational learning.

Clients have more focus on greener products and a circular economy awareness (one described it as the “3Rs - Reduce, Re-use,

Recycle”).

More 'macro' thinking

- Re-positioning to global demand for commodities and decarbonisation

- Greater sensitivity to volatility e.g. commodity prices/exchange rates

- Awareness that changes in china and US have a direct or indirect impact

- Greener products and Scope 3 emissions with suppliers is now front of mind

- Larger companies are seeking stable global arrangements with major suppliers

- Like everyone we have limited resources and Castrol to be honest, play only a very small part. They don't have a massive influence over our business and the outcome

Increasingly challenged

- Sales & technical teams working well together. 'Trusted Advisor'.

- #1 with increased volume and more clients but constantly having to defend a premium pricing position

- Competitors have re-grouped post Covid-19 and are attacking on price

- Scope 3 emissions swinging into sharp focus. Shell & Total have built dedicated teams in Sustainability

- Proud of their growth & passionate but feel no autonomy nor backing.

- Implications of past decisions now impacting Castrol. Were the leader in innovation, new behind the curve

Pressures faced in current role

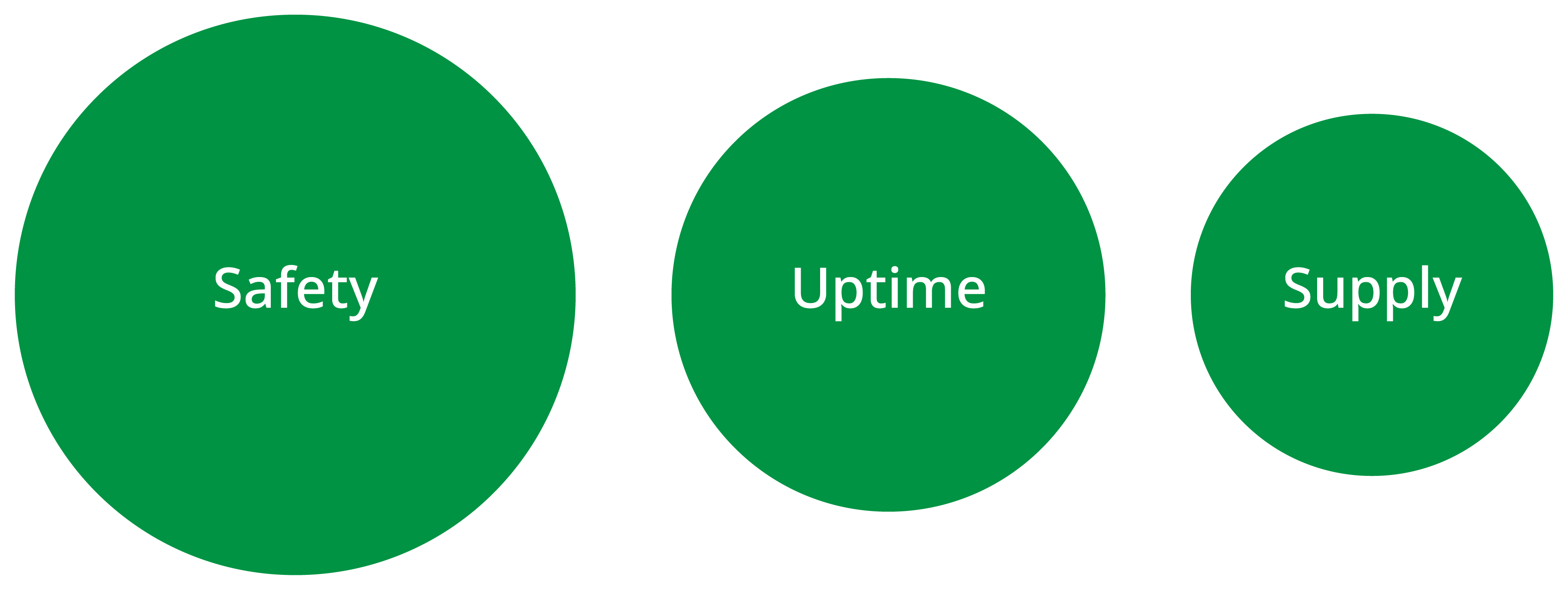

While sustainability is the primary pressure in discussions, safety remains the priority

Share Of Action

Strategic Sourcing Manager, US

It does not really matter what the cost of an item is, if you can’t get it

Global Procurement Manager, AU

There is a lot of opportunity to improve

Share Of mind

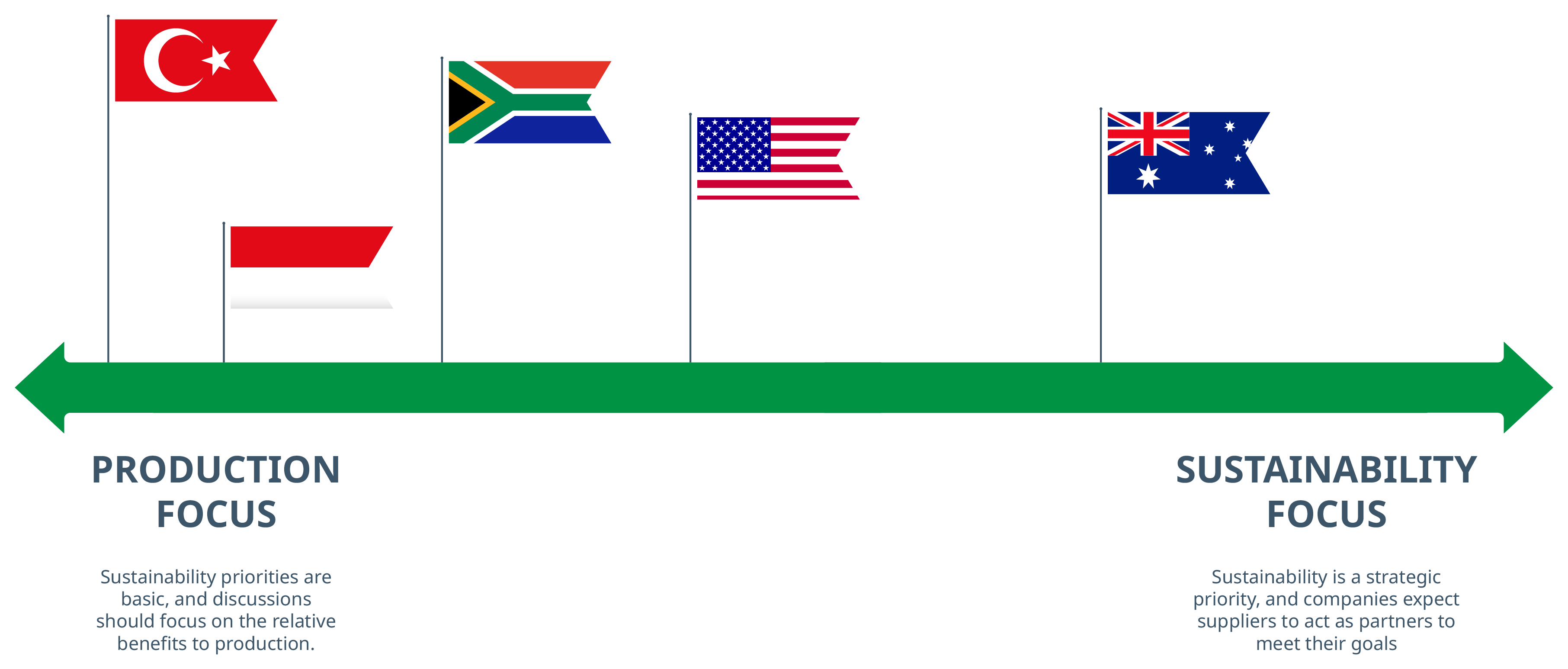

Sustainability and transition are a major element of the discussions and are clearly top of mind for the sector, albeit at different stages of development for each country.

Stages of sustainability development

Discussions around sustainability should take account of the relative stages of sustainability development

On-site maintenance Manager TR

Remote monitoring of machinery is very helpful since visiting every machine every morning is not physically feasible. It’s important to

intervene before breakdowns.

Procurement Manager TR

Techniques and technology are being renewed faster and faster every day and we are a bit incapable of renewing ourselves.

Internal and external demands

The need for sustainability is both an internal and external pressure in Australia

Internal

1 . SUSTAINABILITY

Sustainability is a declared

core strategic aim for most

management boards, so

there is internal pressure

to meet targets.

2 . COST EFFICIENCY

Sustainability is a declared

core strategic aim for most

management boards, so

there is internal pressure

to meet targets.

OEM After-sales Manager, AU

A lot more attention from Procurement on improving the company’s own ‘greener’ credentials, whilst reaching company revenue & P/L stretch targets.

External

1 . SUSTAINABILITY

Impetus increasing from

customers including ESG

strategic aims into new

contract frameworks (&

government requirements).

2 . TECHNICAL PERFORMANCE

Maintaining supply and

performance, and

incremental improvements

are the core challenges.

OEM After-sales Manager, AU

This move to greener operation in our supply chain is underway, packaging, pallets, biodegradable boxes and tape – a lot to do yet to get to optimal solutions.

New developments in technology

There are three broad progression stages of technological development in the sector

Digitization & Data efficiency

Still a requirement for ‘entry level’ technology solutions, striking the right balance with needs.

Managing performance

Optimizing performance

Using AI and large learning models to improve performance and efficiency of products. Big data and AI used to maximise uptime and provide early warning of issues and dangers.

How can Castrol help with technology and digitization?

Innovation, integration and improvement are three main areas where Castrol’s help is required in Australia

Development of new products

Integration with client systems

Improve current product performance

Global Procurement Manager, AU

Castrol are a bit of a funny business. They have this great idea, but it’s really hard to get it out of them! They don’t seem to have a lot in the pipeline to get more business with us.

General Procurement Manager, AU

Easy provision of e-Catalogues, the ability to check order times & expediting, proactive pushing of incoming product developments and specifications. Having information at the tips of one’s fingers helps with fast decision making.

General Procurement Manager, AU

Castrol do oil analysis but it is one metric only, they could add others, number of hours operating, load weights carried, fuel consumption”.

Category Specialist, AU

Castrol do oil analysis but it is one metric only, they could add others, number of hours operating, load weights carried, fuel consumption.

How can Castrol help with technology & digitization

There are three broad stages of technological development in the sector

Synergy with wider corporate footprint

Laboratory Analysis

Training

Condition Monitoring Technician, ZA

Continuous Fluid Dynamics modelling is the future because it helps you determine your failures.

Head of Maintenance & Plant, ID

I have discussed several times with the Castrol team that we urgently need some form of lubricant performance analysis now. The laboratory setup can be a static stationary lab or a dynamic one to effectively assess equipment health”.

Sales Manager, ZA

Mining, it’s both fuels and lubricants, right? And obviously fuel has a massive impact in terms of the carbon emissions and potential savings that could be shown from a fuel efficiency point of view.

How Castrol can help with sustainability

There is a clear divide between the needs in Australia and the other markets

1. PRODUCT SPECIFICS

– In Australia, sustainability assistance is required

for specific product development areas.

– Specific areas mentioned includes bio lubes, oil

and filtration for hydraulic circuits, SP150 Alpha

gear oil.

– Provide a clear roadmap of delivery

1 . GENERALIZATION

– Technical support and advice is also mentioned in this context.

Castrol as a supplier

There are clear indications of improvements Castrol could make as a supplier

Communication of wider business plans

Improve speed of development

Leverage corporate footprint

Strategic Sourcing Manager, US

I definitely want to better understand what Castrol’s 3–5-year plan is as a company is the mining space, better understand what they are looking to do.

Sales Manager, SA

It’s really about looking at things like LNG, gas, biodiesel, nitrogen and knowing what sort of timelines Castrol are working on.

If you could get Castrol to make one improvement to benefit your business

“Innovations and evidence; Castrol are not great at providing evidence and justification for products”.

| Way of Working | New Products | Bigger Thinking/Prove ROI |

|---|---|---|

| Transparency – better support, better information, better pricing and promotion Reduce the complexity of the 2,000-line price update sheet, every 6 months. “During the tender, I mentioned that I was really confused about how to invite Castrol. I didn’t know who to contact. The available contacts were more related to retail, not B2B” | Transparency – better support, better information, better pricing and promotion Reduce the complexity of the 2,000-line price update sheet, every 6 months. “During the tender, I mentioned that I was really confused about how to invite Castrol. I didn’t know who to contact. The available contacts were more related to retail, not B2B” | Castrol to think as a strategic partner with a longer-term view than a short-term tactical transaction. e.g. to construction customers, whilst this sector is slow to keep them for everyone. Prove Castrol are worth a premium. Competitors clearly offer the same value propositionr. Castrol are taking longer to understand the differentiation and gap in market has much closed. |

| Any new variant oil requires a 2-3 years approval cycle. Must be quicker Move more quickly and speed up any process for new solutions, to fit their business as it grows and evolves. | Communicate the benefits of using bio lubes in respect of wear, moisture, heat and lifetime. So ODI extension, down time reduction, more years out of equipment. All would make a case for the higher cost of the product. | “To be more proactive with understanding how they can drive productivity in our business through extending the life of component parts. This is absolutely in their wheelhouse and their interest. But they’ve got to be competitive to be in the game” |

| Opportunity or initiatives in a strategic partnership can weigh the decision beyond that of bottom-line cost. Technical documentation and training on site | Everyone needs to make continuous improvements and think about how to upsell their value. | Castrol make the sales pitch about being more expensive but generating more value “Castrol could share or come up with their own ideas of hydrocarbon management for mobile and fixed plant equipment”. |

How could Castrol help you to achieve improvements in Technology and Digitalisation

“Manufacturing and extraction processes stay on, no downtime. Keep the cash register ringing”.

| Idea | KPI |

|---|---|

| Improve the business case for bio-degradable oils, be more knowledgeable on new synthetic performance and “replacements on fail”. | More preventative maintenance. Run machines for longer. Better understanding of ”how oil frequencies will change, how oil and filtration need to adapt; Improve oil drain intervals. Have a better idea of how service and maintenance should look”. |

| Integration with procurement systems to provide e-Catalogues, the ability to check order times and expediting. Safe ways to stop corrosion of steel or copper bearing alloys. Proactive pushing of incoming product developments & specifications, value adds – e.g. the new grease cartridges. | Performance monitoring Information instantly available to help with fast decision making. Linking technology to monitor and report things like oil changes in draglines and trucks and how well the equipment is performing, stretching maintenance intervals, etc. |

| Castrol do oil analysis, but it is one metric only. Add others, # of hours operating, load weights carried, fuel consumption. | A spread of metrics – better information to make better decisions to either save on spend or maximise return from it |

| Improvement in grease bin usage. The Castrol Grease Bin locator and inventory status system (using GPS) seems very useful. | Alerts for depleted stock and location of the next nearest supply bin with the right product in stock. |

| Reviewing existing and new products and new formulations e.g. the bio/synthetic gear oil with improved wear capability (fully synthetic with some plastic “smoothing” component). | Extended life of units and machinery from less wear, extended Oil Drain Intervals (ODI) |

| Prove better lubricants mean less equipment needs to be bought, as often | Extended machinery life, less oil being purchased |

How could Castrol help you with improvements towards your sustainability goals

“The next tender to Castrol will highlight a lot of these, for detailed answers, they need to be more forthcoming”.

| Idea | KPI |

|---|---|

| How will oil and filtration for hydraulics look for electrically driven systems? What need to change, how do they adapt? Development of ultra-low ash oil to extent DPF service life | “They are not presenting their best to us, currently. New sustainability products and new approaches present different technical problems and requirements. Esp, new equipment” |

| Extended life products, especially for dump truck oil since they use a lot of that (more than anything) and hydraulic oils. Extended service intervals, reduced volume of fluid bought (even if it is for a comparable total cost). | “Our target is a 5-10% reduction on the previous year’s spend” “We want a 15% reduction in total cost across our mines in AU” |

| Bio lubes, SP150, etc tested and available for use. | Traceability of sources, sustainability certification. |

| New gears oils, tech support, sample analysis and testing. | Extended service intervals, lower downtime, extended machine life – overall reduced costs. More profit. |

| Supply chain reliability. On time delivery, with decent tracking. Reduce inventory, cash flow, stock risk, alleviate freight/logistics issues. | Company target is 95% of items ordered are delivered in full and on time, (currently Castrol are 80-85%). Castrol must hit the 95% target before 2026 (and ideally higher, nearer to 99%) |

| “Everyone being smarter and having improved maintenance knowledge, achieving more carbon offset“ | Reduced cost, reduced oil consumption, improved environmental compliance, effective waste management. Better equipment performance with minimal environmental impact. |

| We all seem 5-10% short on people/vacancies. Having more people would mean everyone spent less time firefighting and not getting burnt out. Sustaining people as well as the environment | 1. Reduce the amount of oil they have to dispose of. 2. Re-use more oil – so that which is re-manufactured/re-refined. 3. Recycle – above 50%, ideally hitting 60%, re-used oil. |

Who leads the lubricant space in Mining ?

- There are 3-4 brands in mining business at the moment. They are competing with each other. One of them is Castrol, one is Mobil, one is Shell.

- Their view is that in areas like extended drain time/ service intervals the main players including Castrol are pretty much at the same level - it is level playing field now.

- In the bulk lubricants Castrol are a good reliable brand - good quality for the price. Other players like Fuchs are developing premium products (greases, hydraulic oils), as are Total.

- Fuel supply was moved to Viva Energy (Shell branded products) for 5 years in 2023

- Shell and Pertamina are seen as leaders due to their strong distribution networks, engagement strategies, and local production capabilities in the mining sector.

- Varies by region (Argentina, Australia, Canada, Dominican Republic, Ghana, Mexico, Peru, Suriname), but notable names: Shell, Mobil, Castrol, Total. A niche supplier for speciality lubes would be Fuchs

- Does not see any of the lubricant companies as setting the world alight "they are all pretty much run of the mill". See Castrol behind his 2 other main lub suppliers - Fuchs (e.g speciality lubes) and Shell

- In SA, Total is the market leader (in terms of market share). Arveen thinks Masana are a close #2

- Castrol does the supply job well. Some companies are having supply or production issues.

- They are the leaders - the followers are local brands plus Total and Lukoil.

- Not really aware of anyone else who is doing a better job than Castrol

- Total made a big splash in Mining (they mentioned a 90-60 oil) and won a lot of business with a lower priced oil

- Want better communication and relationships/account management

- In general they use Castrol for almost all lubricants, it is a brand that meets all their needs.

- Shell's commitment to B2B partnerships, strong local presence, and comprehensive support services make it a preferred choice. Pertamina's extensive local production and government support also contribute to its leading position.

- Shell's ability to maintain high standards in both product quality and customer service positions them as a leader

- Don't have a complete picture on speciality oils since not all are supplied by Castrol

- Fuchs stands out a bit more for him as it has a AU operation with a lab and in territory blending so was less susceptible to freight issues during COVID. Recalls on job that used Shell products that were blended in Singapore exposing a massive supply chain risk - so they fell back on Fuchs because they had local blending and large storage/reserves, all within 2 hours of their HQ. Expects Castrol have overseas blending but good local tech team and a large storage facility in

- From liasing with different people, they seem to have quite a good lubrication programme

- Mobil are a good global brand for engine oil and and grease with good quality - they use a lot in in their mills

- Fuchs "are a smaller company and a lot more agile. Their engine oils are stand-out, good product that is more cost effective. They are much more customer oriented than Castrol"

- Total have the Anglo contract which equates to maybe 300 million litres of fuel and 12 to 13 million litres of lubricants