Executive summary

The world’s top mining companies have an important story to tell. They are helping feed the world while

lighting the way to a low-carbon future and providing materials for infrastructure development and consumer

demand. They are a force for good, critical to life in the 21st century as we know it. Yet this tale remains

largely obscured, hidden from the view of the public and even investors. The industry is often accused of

lacking transparency, and it could certainly be more open about its impacts.

Powerful trends are underpinning the demand that miners will need to supply if they are to remain profitable

and competitive in a world where the pace of change is accelerating. One vein that the Top 40 mining

companies in our report need to tap is urban mining, or recycling. This approach often produces

commodities with a significantly reduced environmental footprint, which can command a green premium.

Technology must also be harnessed to maintain and grow productivity throughout the mine life cycle. Mining

needs to unlock AI to advance productivity and extend the vast health and safety improvements the industry

has already made. And without mining, there would be neither AI nor the game-changing impact the

technology will have on other industries and society more widely. The semiconductor chips that AI

applications require contain metals such as copper, zinc and gold.

Amid a new and ever-changing landscape, mergers and acquisitions (M&A) remain a crucial strategy for

miners that want to maintain their competitive advantage even while the industry grows in new terrain in

response to emerging demand. The percentage of completed mining deals involving the Top 40 that were

focused on critical minerals rose to 40% in 2023 from 22% in 2019, underlining this seismic shift driving M&A

activity. Copper and lithium dominated such deals, accounting for over 70% of them by volume, up

marginally from 2022.

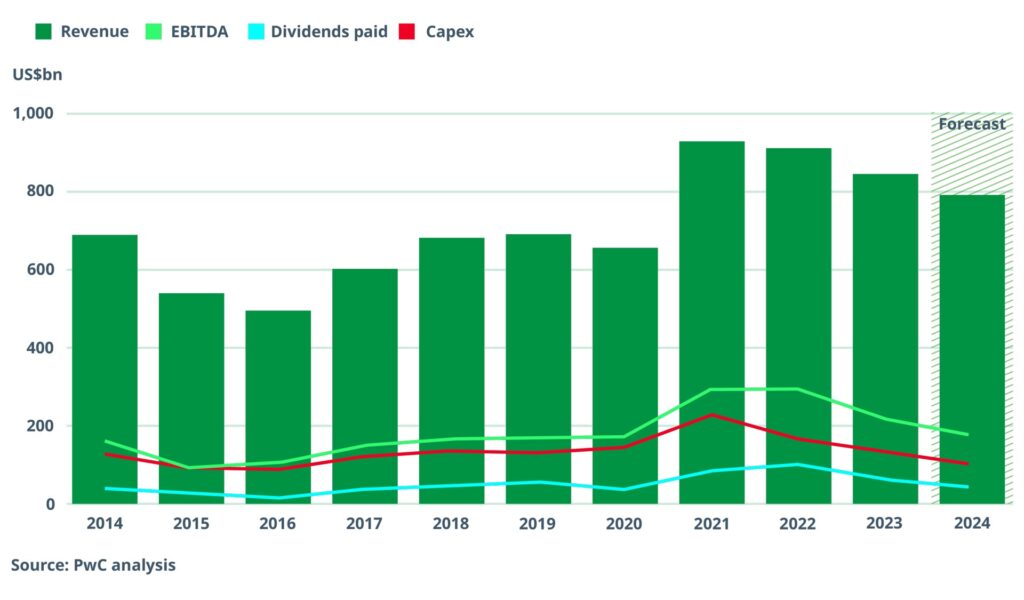

While attempting to navigate this changing and challenging field, the Top 40’s financial performance in 2023

was squeezed by falling commodity prices and rising costs. Revenues fell more than 7%, even as production of

key commodities rose. But by using the emerging technical tools that are already available, the industry can

achieve productivity gains that will contain costs, and, with an eye to an expected rebound in commodity

prices, help position mining for the future.

A sustainable industry will be able to fulfil its vital role in providing critical minerals to sustain life. Earth’s

endowment of natural resources is finite. There is no better time than now for the Top 40 to maximise their

positive long-term impact while sharing gains with all stakeholders.

Demanding times

The global mining industry faced a challenge in 2023 that was at once unprecedented and familiar. The

financial performance of the world’s Top 40 mining companies was squeezed by falling commodity prices

and rising costs. Revenues fell more than 7%, despite increases in the production of key commodities, and

profits shrunk, too; 2024 promises a continuation of these trends, marking the first time since 2016 that

industry revenues will fall for a second consecutive year. And a mix of cyclical and structural issues compels

leading miners to invest for growth and transformation even as revenues and profit margins come under

pressure.

Financial metric are under pressure

Mining occupies a unique role among global industries. The world’s top mining companies are helping feed

the world while lighting the path to a low-carbon future and providing materials for infrastructure

development and consumer needs. These structural trends underpin the demand that miners will have to

meet in a world where the pace of change and disruption is accelerating. As regulatory, economic and

societal pressures increase, mining companies are busily reinventing their business models so they can

create value in new ways while working more effectively as important players in burgeoning ecosystems.

When the cycle turns

In recent years, the industry has faced pressure to invest in sufficient mining capacity and production to

meet the current and expected demand growth for metals supporting the energy transition. But markets

aren’t always completely efficient. In 2023, the prices of lithium, copper, nickel and cobalt fell sharply, as

portions of the lumpy supply response came on stream while demand growth was temporarily stunted. At the

same time, the price of uranium rose—with demand driven by growth in the nuclear industry after a decade

of virtually no investment in supply. The spot price of uranium soared from below US$50/lb in 2022 to more

than US$100/lb in early 2024. Although commodity prices remain well above pre-covid price levels, inflation

adjustments show that only coal and gold significantly exceed 2019 levels in real terms. The drop in prices

for coal, lithium, copper and platinum group metals (PGMs) resulted in six companies falling out of the Top

40, while the rally in gold and uranium prices propelled six replacements into it.

Mining’s impact on food security

Mining plays a critical role in global food security and in reducing the impact of agricultural production on the

environment, due to its direct link in supplying the raw materials necessary for a wide range of inputs and

consumables required in agriculture. Improved crop yields support a reduction in deforestation—currently

responsible for 20% of total global greenhouse gas emissions. Of the six core uses in which minerals and

metals improve food security, fertiliser is the most important.

Improve food security viz. Fertilisers, Water treatment, Soil improvements, Micronutrient supplements,

Pesticides & Herbicides and Animal feed supplements, Fertiliser is the most important.

To grow the agricultural products that feed the 1.9 billion additional people who will live on the planet by

2050, global annual production of phosphorus needs to increase by 55 million tonnes per year (25%) by

2050.

Recycling impact

Covid, restrictive trade policies, increased energy prices, and the Russian invasion of Ukraine have caused

fertiliser prices to spike and supply to decline over the past several years. Given the disruptions, there is a

greater need to source these minerals from elsewhere. At the same time, reasonably abundant new uses of

phosphorus—for example, in lithium-iron-phosphate (LFP) batteries, which account for almost one-third of

new electric vehicle (EV) supply—could increase competing demand for the available resources.

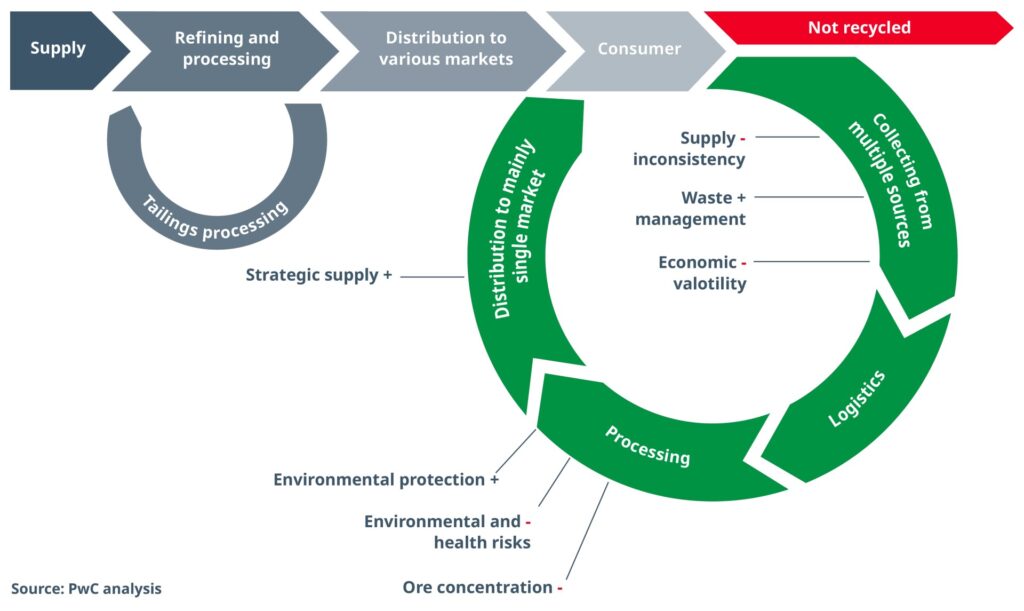

The impact of urban mining

Alternative methods can provide only a modest supplement to the supply of phosphorus and potassium. But

in other areas, the recycling of minerals at scale is already common, and it’s a key adjunct to traditional

mining. Urban mining, also known as recycling or secondary production, has evolved into a sophisticated,

multibillion-dollar industry. In certain instances, recycled metals may command a ‘green premium,’ as they

appeal to sustainability-minded consumers and industrial users who prioritise environmentally responsible

production methods.

In theory, using more recycled materials could reduce the demand for mined materials. But given the rising

populations and increasing industrial usage, demand is not a zero-sum game. Urban mining presents

significant opportunities for traditional mining companies as they reinvent their business models and find

new methods of value creation in the broader ecosystem (see chart, below). As regulatory requirements

tighten, investing in circular economies will be key in achieving success.

Recycling offers the prospect of a more circular–and sustainable–mining value chain

Advantages in the recycling loop are indicated by a + sign. Disadvantages are shown by a – sign.

AI and mining: A mutually reinforcing relationship

AI systems depend on minerals and metals in several critical ways. Semiconductor chips are made from

silicon, and they also contain such metals as copper, gold, tin, nickel, palladium and silver. Storage devices

rely on metals such as platinum, palladium, and gold for their magnetic and conductive properties. Data

centre facilities use vast amounts of metal in their construction.

The demand for AI is contributing to an increased need for these metals. At the same time, integrating AI into

urban mining will allow the industry to achieve higher efficiency, better material recovery rates, reduced

costs and a lower environmental impact.

26% Proportion of platinum group metal (PGM)

production that’s recycled today. In 2000, it was less than 5%.

Lithium expansion

Lithium producers are underrepresented in the Top 40, because they are often classified as chemical

companies as a result of the focus on processing in the value chain. Given lithium’s critical role in the energy

transition, we aggregated the publicly available financial statements from ten leading lithium miners. The

steady production growth did not always translate into revenue growth, owing to volatile prices. Lithium

investments are generally less capital intensive and have shorter repayment periods. The expected growth

in lithium demand incentivizes significant growth in investment.

The productivity imperative

Urban mining is one of several key pillars in promoting productivity for the industry. But miners are caught

between the pincers of two powerful trends. As noted, commodity prices have been falling. At the same time,

in the last five years, mining production costs have increased by nearly 30%, making it urgent for companies

to invest in cost-saving technology. In today’s increasingly complex mining landscape, expanding

commitments to sustainability, rising production costs, declining ore grades, more dispersed reserves and a

shortage of technology-savvy talent are all contributing to the imperative for the Top 40 mining companies to

focus on productivity.

Over the past 20 years, through cycles of growth and retrenchment, the mining industry has been on a

journey to improve productivity (see timeline, above). Looking ahead, miners have identified clear

opportunities to enhance productivity while mitigating risks and maximising the positive impact in their

business by leveraging technology, fostering innovation and adopting new ways of working. The World

Economic Forum reports forecasts from technology solutions providers and business intelligence suppliers

that the total internet of things (IOT) market and potential incremental value of technological advances in

mining will be worth billions in US dollars by 2030. Progress can be seen in a range of activities:

Value chain process optimisation.

In processes ranging from exploration to extraction, as well as in

transportation and in management of key resources (e.g., energy and water), miners are thoroughly

reviewing and optimising production and operation. In Chile, at the world’s largest copper mine, Escondida,

BHP and Microsoft are collaborating. Using real- time data from concentrator plants and recommendations

based on Microsoft’s Azure platform, concentrator operators at Escondida can adjust operating variables to

improve ore processing and grade recovery. Freeport-McMoRan has made investments in artificial

intelligence and data analytics to maximise copper extraction under the Americas’ Concentrator initiative,

starting in Bagdad, Arizona, and expanding to other operations in the region.

Increased reliability via investments in renewable energy.

With operations in remote areas, companies

often face the prospect of interruption in power supplies even as they strive to decarbonise. Anglo American

entered into a partnership in 2022 with EDF Renewables to develop a regional renewable energy ecosystem

in South Africa, a country stricken by electricity shortages. Envusa Energy, the jointly owned company they

formed, plans to develop at least 500 megawatts of solar and wind capacity, and has ambitions to increase

capacity to three to five gigawatts by 2030.

Increased reliability via investments in renewable energy.

With operations in remote areas, companies

often face the prospect of interruption in power supplies even as they strive to decarbonise. Anglo American

entered into a partnership in 2022 with EDF Renewables to develop a regional renewable energy ecosystem

in South Africa, a country stricken by electricity shortages. Envusa Energy, the jointly owned company they

formed, plans to develop at least 500 megawatts of solar and wind capacity, and has ambitions to increase

capacity to three to five gigawatts by 2030.

Extraction technologies designed to face more complex orebodies.

Chalcopyrite and low-grade primary

sulphates pose challenges to the efficiency of copper mining. And the presence of clays and impurities in

main orebodies affects productivity, owing to operational constraints. In 2023, BHP’s venture arm invested in

Ceibo, a start-up that is developing a revolutionary process to leach low-grade primary copper sulphides.

Automation and advanced technology.

Automation, robotics and advanced control systems can be fully

integrated to enhance efficiency in mineral extraction and processing. Autonomous mining is on the rise, and

such trucks and equipment are operating more safely with less human intervention. First Quantum Minerals

utilises IOT technology for energy efficiency and process optimisation, and Barrick Gold is using predictive

tools for gold production planning.

Safer and more sustainable operations.

Health, safety and environment management systems enable

proactive monitoring and managing of workplace safety. Ivanhoe Mines and Zijin Mining Group are using

virtual reality and simulator training to provide accelerated opportunities for upskilling the local workforce at

the Kamoa-Kakula copper mine in the Democratic Republic of Congo.

Sustainability

Sustainability considerations have been a pivotal element in transaction decisions. In their quest to

decarbonise, mining companies are investing in renewable energy projects. Such projects bolster their

sustainability profiles and help them gain greater control over one of their most significant operational costs.

Rio Tinto recently finalised the US$700 million acquisition of a 50% stake in the Giampaolo Group’s Matalco

recycled aluminium business, with an aim of meeting increasing demand for low-carbon aluminium, a key

material in the energy transition.

In March 2024, Vale moved to acquire the 45% of Aliança Energia shares that it didn’t already own, for

approximately US$540 million. The deal brings hydroelectric and wind generation assets into Vale’s portfolio,

strategically aligning the company’s investments with its environmental, social and governance (ESG)

objectives.